net operating working capital turnover

Working Capital Current Assets Current Liabilities or COGS Net Sales Gross Profit or Opening Stock Purchases Closing Stock Example. Operating working capital is a narrower measure than net working capital.

Asset Turnover Ratio Formula And Excel Calculator

The working capital turnover ratio shows the connection between the money used to finance business operations and the revenue a business earns as a result.

. By calculating the sum of each side the following values represent the two inputs required in the operating working capital formula. Working Capital Turnover Ratio Turnover Net Sales Working Capital. The Formula for the Working Capital Turnover Ratio is.

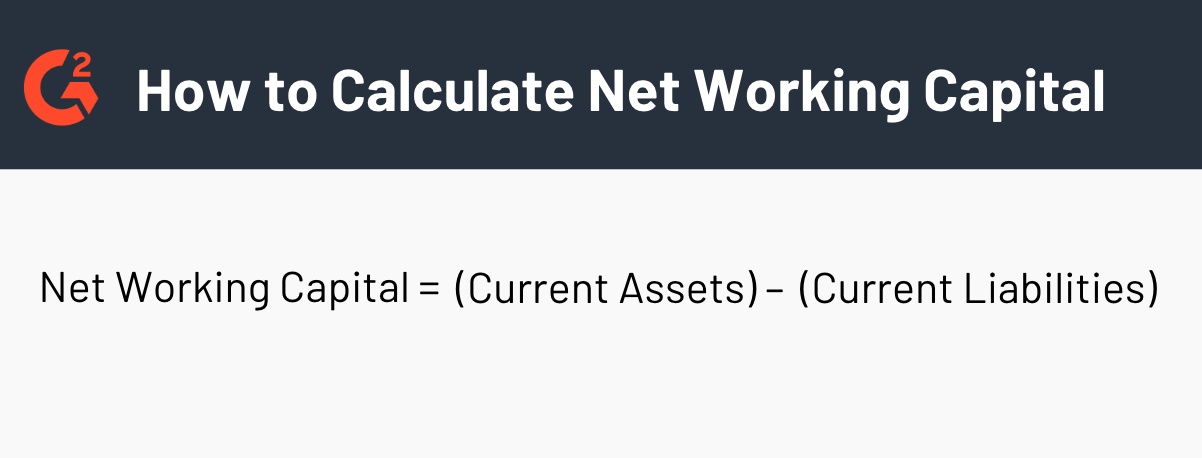

Working capital is the amount of capital left over after subtracting current liabilities from current assets. Net working capital is more comprehensive because it represents the cash and other current assets a company has to invest in operating and. The formula consists of two components net sales and average working capital.

Working Capital Turnover Ratio Formula. Working Capital Turnover Ratio 288. 12000000 Net sales 2000000 Average working capital 60 Working capital turnover ratio.

Operating Current Liabilities 15 million 10 million 5 million 30 million. Working Capital Turnover Ratio Rs 1150000 Rs 400000. The working capital turnover is calculated by taking a companys net sales and dividing them by its working capital.

In principle the working capital turnover or net working capital turnover measures how much money a company required to run the business compared to its ability to. Formula to Calculate Working Capital Turnover Ratio. Net Working Capital Current assets Current liabilities 60000 30000 30000 5 times Significance.

You can define net operating working capital or NOWC as a financial measure or ratio of a companys ability to assume its operating liabilities using its operational assets The formula for NOWC is to add cash account receivable and inventory to one another and deduct from that account payable and accrued expenses. It is also called investment turnover. The Formula for Working Capital Turnover Is.

It measures how efficiently a business turns its working capital into increase sales. Operating Current Assets 25 million 40 million 5 million 70 million. Current Liabilities 30000.

Net Operating Working Capital Turnover Net operating working capital is equal to from ACCOUNT MISC at University of National Development Veteran Yogyakarta. The calculation of its working capital turnover ratio is. Working Capital Turnover Net Annual Sales Average Working Capital beginaligned textWorking Capital TurnoverfractextNet Annual Sales.

Working capital turnover Net annual sales Working capital. Working Capital Turnover Ratio Cost of Sales Net Working Capital. Average Working Capital Working Capital on The Beginning of the Period Working Capital on The End of the Period 2.

Upon netting those two values against each other the operating working capital of. In this formula the working capital is calculated by subtracting a companys current liabilities from its current assets. Net Sales Sales Returns.

It shows companys efficiency in generating sales revenue using total working capital available in the business during a particular period of time. Ad HSBC Has a Range Of Solutions To Help You Self-Fund Growth Expand Your Business Reach. Working Capital Turnover Ratio Net Sales Average Working Capital.

Working capital turnover refers to a ratio providing insights as to the efficiency of a companys use of its working capital to run the business and scale. Working capital can be negative if a companys current assets are less than its current liabilities. Working Capital Turnover 190000 95000 20x.

The working capital turnover is a ratio to quantify the proportion of net sales to working capital. Check out our trade and receivables financing options. The working capital turnover ratio uses net sales and average working capital to show if a company can support growth with capital.

Since net sales cannot be negative the turnover ratio can turn negative when a. What Is Working Capital Turnover. This indicator shows the value in percentage terms about how many times the net invested operating capital NOIC is turned due to sales total invoiced.

For example if a company 10 million in sales for a calendar year 2 million in working capital its working capital turnover ratio would be 5 million 10 million net annual sales. Working capital turnover ratio is computed by dividing the net sales by average working capital. Since we now have the two necessary inputs to calculate the working capital turnover the remaining step is to divide net sales by NWC.

From the 20x working capital turnover ratio we can conclude that the business generates 2 in net. The value indicates how many times 1 euro of net invested operating capital has been converted into turnover to express whether the company has a net invested operating. Current Assets 10000 5000 25000 20000 60000.

ABC Company has 12000000 of net sales over the past twelve months and average working capital during that period of 2000000. Calculate working capital turnover ratio. The sales-to-working capital ratio is a measurement of if there is enough cash in a business to support sales.

Operating working capital focuses more on day-to-day operations whereas net working capital looks at all assets and liabilities. Working capital is calculated as the difference between a companys current assets and current. Net Working Capital NWC 60000 80000 40000 5000 NWC 95000.

Where Net Sales Total Sales Returns Discounts. Example of the Working Capital Turnover Ratio. Calculate working capital turnover ratio from the following data.

Hence the Working Capital Turnover ratio is 288 times which means that for every sale of the unit 288 Working Capital is utilized for the period.

Working Capital Turnover Ratio Meaning Formula Calculation

What Is Net Working Capital How To Calculate Nwc Formula

Working Capital Turnover Ratio Double Entry Bookkeeping

Activity Ratio Formula And Turnover Efficiency Metrics

Asset Turnover Ratio Formula Calculator Excel Template

Working Capital Turnover Efinancemanagement Com

What Is Net Working Capital Daily Business

Working Capital Turnover Ratio Meaning Formula Calculation

Working Capital Turnover Ratio Formula And Calculator

Working Capital Turnover Ratio Formula Calculator Excel Template

Asset Turnover Ratio How To Calculate The Asset Turnover Ratio

Working Capital Turnover Ratio Meaning Formula Calculation

Working Capital Turnover Ratio Different Examples With Advantages

Working Capital Turnover Ratio Formula Calculator Excel Template

How To Calculate Working Capital Turnover Ratio Flow Capital

Working Capital Turnover Ratio Different Examples With Advantages

Working Capital Turnover Ratio Formula And Calculator

Operating Asset Turnover Ratio Overview Formula How To Interpret